-

Agroclimatica

Transforming

Agricultural

Financing with

Climate IntelligenceDrives world-class portfolio management with our

climate intelligence platform designed for banks and institutions

financial. Accurately assess agricultural risks, expand your

portfolio and reduce delinquencies.

News

Agroclimatica 2025

Banco ADEMI fortalece su estrategia para el sector agropecuario con soluciones tecnológicas de Agroclimatica

Banpro (Grupo Promerica) fortalece su gestión del riesgo agropecuario con apoyo de responsAbility Investments AG y su programa #GCPF.

Agroclimatica y Climatica App se unen a Universidad Zamorano y BID Lab en el proyecto AgroHub 🇬🇹🇸🇻🇭🇳

Business Financial Center joins Agroclimatica in Panama

Agroclimática and Climatica App win the FIID Fund Challenge by Swisscontact

Agroclimatica participates in the GCPF LATAM Exchange 2025 in Lima, Peru

¡Agroclimatica en Panamá! 🇵🇦

More than 60 institutions already manage their portfolios with Agroclimatica

Our Solutions

Proactive Management

for Your Entire Agricultural Portfolio

By integrating climate and production data into credit management, financial institutions not only reduce losses, but also open up new lines of business, expand inclusion and meet the highest sustainability standards.

- Crop estimation

- Cultivos climáticamente inteligentes

- Adaptation and Resilience Measures

- Carbon footprint (CO2)

- Water Footprint

- Global Forest Watch: Deforestation Meter

The future of agricultural financing

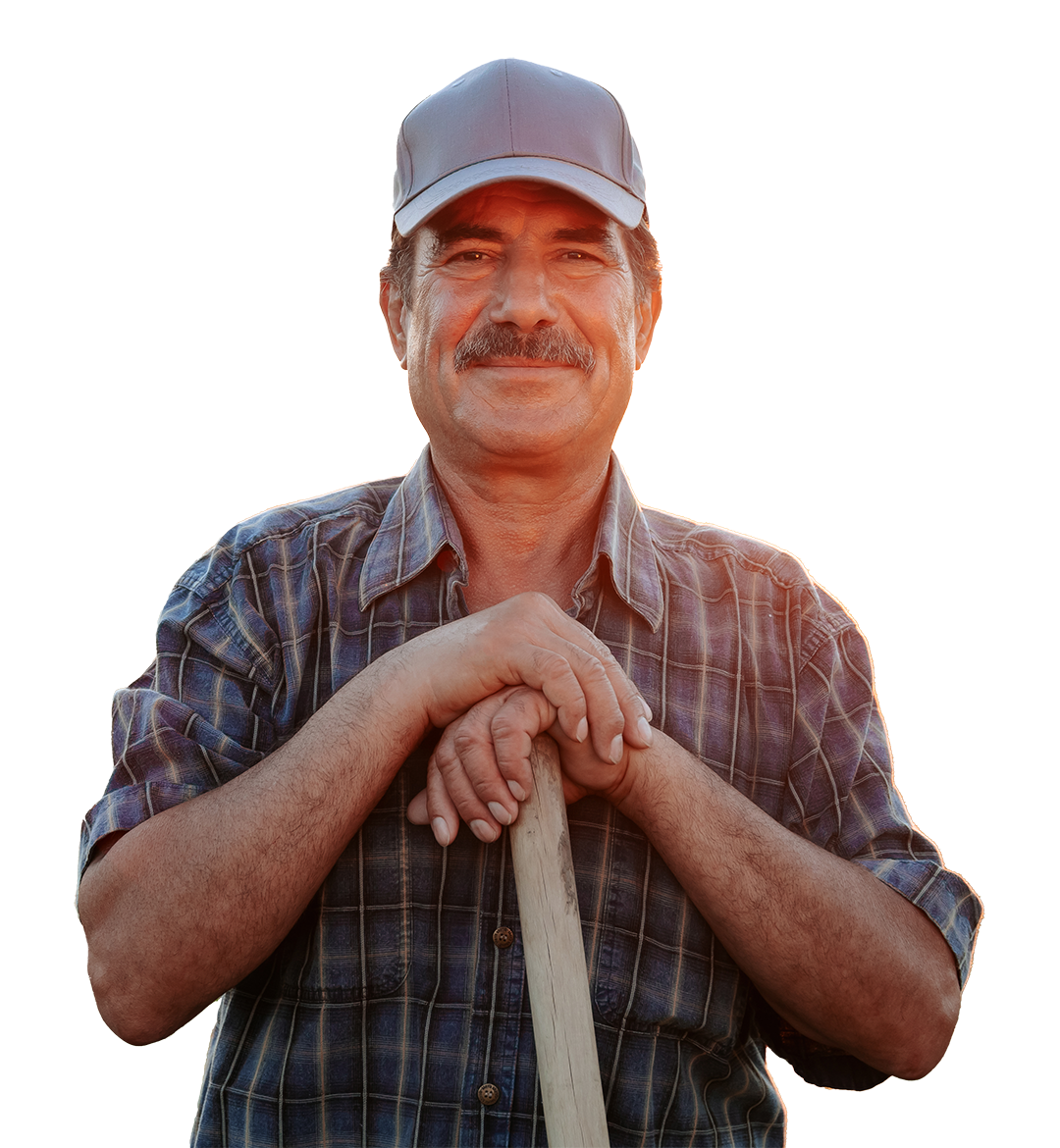

An increasingly complex scenario: Altered rainfall patterns, rising temperatures, more frequent droughts and pests directly affect productivity and profitability. These changes not only threaten sustainable food production, but also reduce farmers' resilience and limit their access to financing.

Agroclimatica arises to transform that uncertainty into actionable intelligence, turning climate risks into business opportunities, regulatory compliance and sustainability.

CLIMATE INTELIGENCE FOR YOUR ENTIRE PORTFOLIO

From uncertainty to resilience: how quantifying climate risk transforms agricultural credit.

01

Identifies in real time the climatic vulnerability of each client, zone or crop within the agricultural portfolio. Allows financial institutions to measure cumulative risks and anticipate loss scenarios.

Integrates monitoring of deforestation, carbon footprint and sustainable taxonomies, facilitating alignment with regulatory frameworks and enabling access to green funding.

02

Allows analysis of complete portfolios by portfolio backtestingThe system is based on a set of performance baselines and clear objectives. In this way, institutions can measure progress, anticipate vulnerabilities and strengthen the sustainability of their operations.

03

It offers customized technical measures aligned with national regulations (NAMA) and international frameworks. Each recommendation can be transformed into a green financial product, creating new opportunities for institutions and producers.

04

The challenges we solve

Financial institutions face barriers that limit the sustainability and growth of agricultural credit. These are the main gaps that Agroclimatica helps to overcome:

Traditional risk models ignore agroclimatic risk, leaving institutions vulnerable to droughts, floods, pests or other phenomena that directly impact the performance of their portfolio.

With Agroclimatica, this uncertainty is converted into reliable data that strengthens portfolio management.

In extreme weather scenarios, crop losses and production losses can increase delinquencies in rural portfolios up to 40%.

By quantifying risks, institutions can anticipate, better segment and reduce delinquencies to sustainable levels.

Without objective information, banks do not know in detail the risks faced by producers, and are unable to create agricultural insurance or green credits tailored to their needs.

With Agroclimatica, risk translates into opportunities: new financial products aligned with ESG and climate resilience.

Millions of farmers remain out of formal credit due to lack of climate information.

By measuring their actual exposure, Agroclimatica makes them visible and bankable, closing a global gap of more than USD 80 billion.

Contact us at